Share this

Comprehensive Guide to Budgeting and Forecasting Software: Optimizing Financial Planning are essential components of financial management for businesses of all sizes. This comprehensive guide explores the importance of budgeting and forecasting software, key features to consider, top solutions available, best practices for implementation, and future trends shaping the industry.

Understanding Budgeting and Forecasting Software

What is Budgeting and Forecasting Software?

Comprehensive Guide to Budgeting and Forecasting Software: Optimizing Financial Planning enables organizations to plan, allocate resources, and predict financial outcomes based on historical data and market trends. It helps businesses streamline financial planning processes, improve decision-making, and achieve strategic goals.

Importance of Budgeting and Forecasting

- Financial Planning: Guides financial decisions by projecting revenues, expenses, and cash flow over a specific period.

- Resource Allocation: Allocates resources effectively to optimize profitability and manage costs.

- Performance Evaluation: Evaluate financial performance against budgeted goals and forecasts to identify variances and take corrective actions.

- Risk Management: Anticipates financial risks and opportunities to mitigate potential losses and capitalize on market trends.

Key Features of Budgeting and Forecasting Software

1. Budget Creation and Management

Creates detailed budgets, allocates funds to departments or projects, and tracks spending against budgeted targets.

2. Forecasting Tools

Uses historical data, statistical algorithms, and predictive analytics to forecast future financial performance and trends.

3. Scenario Planning

Models different scenarios (best-case, worst-case, and most likely) to assess the impact of strategic decisions on financial outcomes.

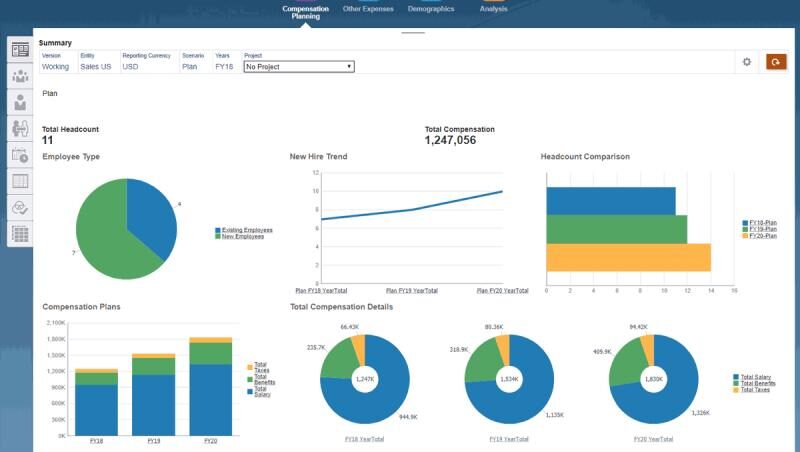

4. Real-Time Reporting

Generates real-time reports, dashboards, and visualizations to monitor key performance indicators (KPIs) and financial metrics.

5. Integration Capabilities

Integrates with accounting software, ERP systems, and business intelligence tools for seamless data synchronization and analysis.

6. Collaboration and Workflow Automation

Facilitates collaboration among stakeholders, automates approval workflows, and ensures data accuracy and consistency.

Benefits of Using Budgeting and Forecasting Software

1. Improved Accuracy and Efficiency

Automates manual processes, reduces errors, and improves the accuracy of financial forecasts and budgeting.

2. Strategic Decision-Making

Provides insights into financial trends, market conditions, and business performance to support informed decision-making.

3. Resource Optimization

Optimizes resource allocation by aligning budgets with strategic priorities and adjusting forecasts based on changing business conditions.

4. Compliance and Governance

Ensures compliance with financial regulations, internal policies, and industry standards through centralized control and audit trails.

5. Scalability and Flexibility

Scales with business growth adapt to evolving needs and support multi-entity or international operations with localized currency and tax features.

Top Budgeting and Forecasting Software Solutions

1. Adaptive Insights

Adaptive Insights offers cloud-based budgeting, forecasting, and planning software with intuitive dashboards, scenario analysis, and predictive analytics.

2. Oracle NetSuite Planning and Budgeting Cloud

Oracle NetSuite Planning and Budgeting Cloud provides comprehensive financial planning capabilities, including real-time collaboration, modeling, and reporting.

3. Anaplan

Anaplan offers a flexible platform for connected planning, enabling organizations to align financial plans with operational strategies and market dynamics.

4. SAP Business Planning and Consolidation (BPC)

SAP BPC integrates financial and operational planning processes, featuring real-time analytics, budget simulations, and compliance management.

5. Budget Maestro

Budget Maestro provides automated budgeting and forecasting software tailored for small to mid-sized businesses, with cash flow analysis and scenario planning tools.

Best Practices for Implementing Budgeting and Forecasting Software

1. Define Objectives and Goals

Align software implementation with strategic objectives, financial goals, and organizational priorities.

2. Involve Key Stakeholders

Engage finance teams, department heads, and executives in software selection, configuration, and training to ensure buy-in and alignment.

3. Customize and Configure

Tailor software settings, templates, and workflows to match business processes, reporting requirements, and industry standards.

4. Provide Training and Support

Offer training sessions, user guides, and ongoing support to empower users and maximize software adoption and utilization.

5. Monitor Performance and Adjust

Regularly review financial data, KPIs, and user feedback to optimize software usage, improve accuracy, and address emerging business needs.

Future Trends in Budgeting and Forecasting Software

1. AI and Machine Learning

AI-powered algorithms will enhance forecasting accuracy, identify trends, and provide predictive insights for proactive decision-making.

2. Blockchain for Financial Transparency

Blockchain technology will improve data integrity, auditability, and transparency in budgeting and financial reporting processes.

3. Advanced Analytics and Visualization

Enhanced data analytics and visualization tools will enable interactive dashboards, scenario modeling, and real-time performance monitoring.

4. Cloud Adoption and Mobility

Increased cloud adoption will offer scalability, accessibility, and collaboration features for distributed teams and remote work environments.

5. Integrated Planning Solutions

Integrated planning platforms will unify financial planning, operational planning, and workforce planning to support holistic business strategies.

Conclusion

Budgeting and forecasting software plays a vital role in enabling organizations to plan, predict, and manage financial performance effectively. By leveraging advanced solutions like Adaptive Insights, Oracle NetSuite Planning and Budgeting Cloud, Anaplan, SAP BPC, and Budget Maestro, businesses can streamline budgeting processes, enhance decision-making, and achieve strategic goals with precision.

Implementing best practices such as defining objectives, involving stakeholders, customizing software settings, providing training, and monitoring performance ensures successful software adoption and optimization. Looking ahead, future trends in budgeting and forecasting software will integrate AI-driven insights, blockchain transparency, advanced analytics, cloud mobility, and integrated planning solutions to empower organizations to achieve financial excellence.